You must understand the idea of trading platforms and signals for commodity trading in Singapore. They are based on software created by professionals, so these platforms can be easily used by anyone interested in any type of Forex trading. This makes them convenient and useful for those who are new to the world of trading. Using such a platform for beginners will make it easier for them to work and learn to trade, and reduce the losses associated with trading the commodities.

All commodities available for online trading can be divided into three main types: agricultural products, metals and energy. It is important to note that trading commodities is not the same as trading the stock market or the value of currencies. It is very important to be able to predict the future correctly. With these assets, you can make a lot of money when you trade positions in the stock market. The business stays open for a long time after the market study. Isn’t often less than a year. In the future, if things go well for the trader, they can open more positions in the market.

Best Commodity Trading Platforms in Singapore

How to trade commodities using Commodity Trading Apps

Luckily, access to investments has been made easier with the introduction of trading platforms that have made trading commodities easier. These programs gave Singaporean investors and traders the ability to easily raise capital and trade commodities.

When you use the online platform and commodity trading apps, you can invest in goods commodities at any time of the day or night. Everybody can buy different kinds of commodities on these commodity brokers. Perhaps you know more about one area than others and can predict how prices will change in that area. Investing in commodities online is a great way to diversify your portfolio and make more money.

Diversification – expanding the range of investments. For example, increasing the number of objects or assets in which you invest.

In fact, from the study conducted by 24Forex, you can access different types of income opportunities by investing in goods. Over the long term, you can use these income opportunities to grow your portfolio and generate consistent income. This is why you need to choose the right platform to invest in commodities.

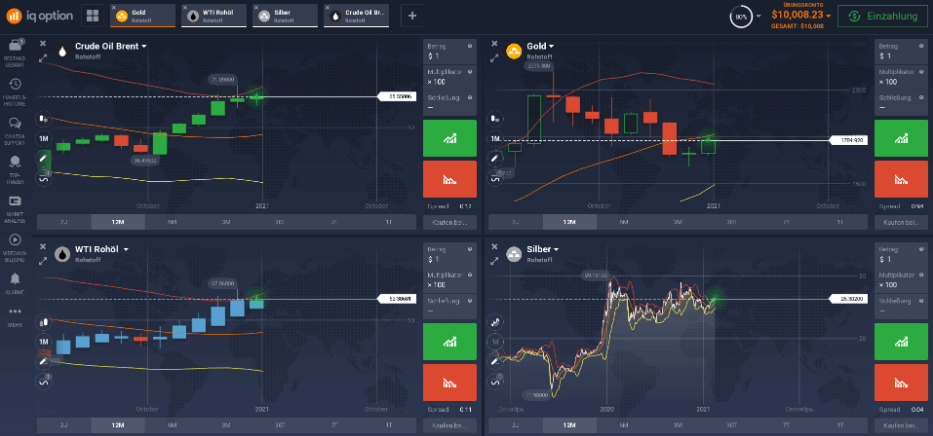

Most traders use technical analysis to some extent, some occasionally, some constantly, to help themselves make trading decisions. They often practice them on a demo account.

What is Commodity Market Technical Analysis? The patterns and indicators on the price chart for a specific commodity are looked at to find out its future direction.

Trading Commodities on a Demo Account

With a demo account, you can practice both the types of technical analysis and other technical analysis tools suitable for you. Every approach will not always be 100% successful. Trading losses are part of the process. Therefore, risk-free investing in commodities through a demo account will help you develop the right trading mindset.

Types of raw materials to invest in Singapore

Typically, there are several types of goods that are more suitable for exchange in international markets. These are gold, silver and oil. It’s very common for people to buy and sell these things on the world’s stock markets every day. It’s important to know how to trade them on a commodity exchange because that’s how you can make money.

What is the essence of investing in commodities? When prices start to rise you can find a seller of a commodity at a bargain price and take advantage of the resale margin, but is it that easy to find a producer or seller of a commodity like oil and store it until resale? And in this situation there is an easy way – it is trading commodities on the stock exchange through a broker.

Basically, a retailer trades with contracts for the future delivery of a commodity. The trader pays a fixed price for the contract. If the price increases from the moment the contract is purchased, the trader makes a profit when the contract expires. If the price falls, the trader will lose money.

Note: There are many things that affect the price of each individual item. Huge fluctuations in the price of goods can occur when there is a shortage or oversupply of goods. As a rule, everything that is offered for sale is subject to changes in supply and demand. In addition, it should be borne in mind that natural disasters and serious political conflicts can lead to dramatic changes in commodity prices.

How to start commodities trading in Singapore?

If you are interested in getting started with commodity trading in Singapore, you need to open an account in order to trade online. Is it possible to open a real demo account? Yes, a commodities trading demo account from IQ Option contains $10,000. That will give you the opportunity to practice trading and learn how to properly understand the industry and use the indicators properly.

You can use the online tools available to check current commodity prices. As you gain experience in trading, you are more likely to know exactly what the market trends are. Along with the available online tools, you will have the opportunity to know the market trend.

After getting some success with a demo account, you may want to open a live account. The good news is that the opening deposit is quite small, only $10. You can try the platform to the fullest, it’s quite a game for reality. Of course you can also start with a larger amount, it all depends on you!

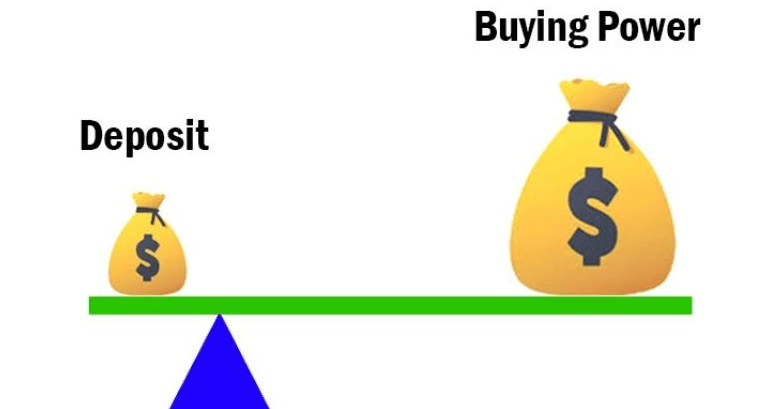

Leverage on Commodity Trading Explained

You can also use leverage to trade commodities online. Leverage, or financial leverage, is a specific ratio of a trader’s own funds (their deposit) to the total amount of money they’re trading. That is, it is a special financial service offered by a brokerage firm to lend a trader a certain amount of money, several times larger than his deposit, so that the client can use it to complete transactions and increase his income.

Conclusion

One of the important considerations to keep in mind when trading the market is that you should always buy when prices are low and sell when prices are high. If you take a position in the market once the market is open, you don’t have the benefit of understanding the expansion or decline of the commodity before the market closes during the day. This means that you miss the opportunity to profit from higher commodity prices.

When trading commodities online, you will come across a trading type like CFD contracts. It is a type of bet between two parties on the future value of a single financial instrument (currency, stock, etc.), where both parties agree to settle an amount equal to the difference between the opening price and the closing price of the position. Hence the term “CFD”. In simple terms, if you buy such a contract and the price of the underlying instrument increases, you will receive the corresponding difference from the broker who sold you the contract. On the other hand, if the rate falls, the difference will be deducted from your account. You can try this variant on both a demo and real account.