How to build a gold investment portfolio?

If the user bought 100 grams of gold at US$66.2/g, the total cost would amount to US$6,620. However, in the event where the gold price drops to US$62.2/g, users are advised not to sell immediately when gold price falls. This is because even though gold prices fluctuate from time to time, but the prices are still rising as a whole in the long run.

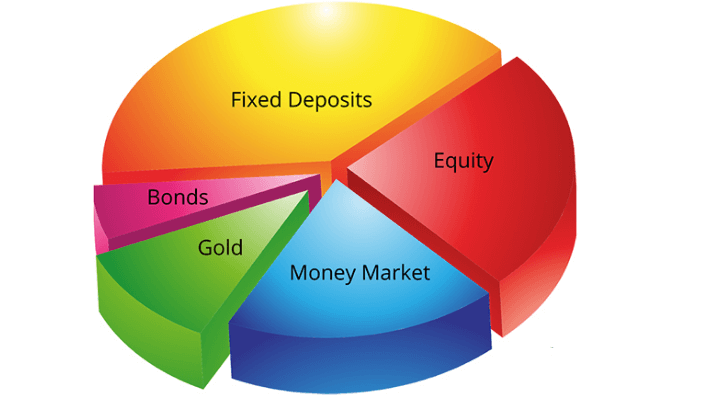

Users should continue buying gold to build an investment portfolio and set aside contingency funds when they invest, so as to open a position when gold prices fall. In this case scenario, the user should continue to buy another 100 grams of gold, amounting to US$6220.

Here is an example to illustrate the profit-loss margin:

| Profit & Loss | |||

| Gold Price (US$) | For the gold bought @ US$66.2/g | For the gold bought @ US$62.2/g | Investment Portfolio (US$) |

| When gold price rebound to 63.2 | 6320-6620=-300 | 6320-6220=100 | -200 |

| When gold price rebound to 64.2 | 6420-6620=-200 | 6420-6220=200 | 0 |

| When gold price rebound to 65.2 | 6520-6620=-100 | 6520-6220=300 | 200 |

| When gold price rebound to 66.2 | 6620-6620=0 | 6620-6220=400 | 400 |

The table above shows that if the user decides to sell the gold hastily after the price falls to US$62.2/g, the user would have suffered a loss of US$400 immediately (US$6220- US$6620= -US$400). On the other hand, if the user follows the investment portfolio strategy illustrated above, the user will be able to make a profit of US$400 when the gold price rebounds.

No Comments found