Expert Option is a forex brokerage firm in Vanuatu. As for what exactly a Forex broker is, it is a company that provides traders with access to platforms that allow them to buy and sell foreign currencies. In this Expert Option Singapore review we discuss the main benefits of the broker as well as its disadvantages.

The first impression is that Singapore traders are allowed on the platform. Read more to find out how to get started.

Expert Option started providing services to traders in 2014 and currently conducts over 30 million trades each month.

They currently have over nine million customer accounts from traders all over the world. Expert Option’s goal is to provide a fully visible online trading experience. To achieve this, it provides its users with an intuitive trading platform and numerous educational materials.

Expert Option Awards and Recognition

When deciding which broker to use, a trader should look at how long the broker has been stable and how well it has been known. The awards that a brokerage has won from well-known groups make people more confident in the world of forex.

Over the years, Expert Option has won a lot of awards. In 2017, they were named the best trading platform at a trade show.

Best Binary Broker in Singapore

| Platform | Deposit | Rating | Description | Trade |

|---|---|---|---|---|

|

$10 |

|

|

Visit Site |

|

$10 |

|

|

Visit Site |

|

$10 |

|

|

Visit Site |

|

$10 |

|

|

Visit Site |

Expert Option Accounts

People who want to trade currencies and other market instruments often get a forex account from their broker. This account is usually used only for that. Most of the time, the number and type of accounts a trader can open with a brokerage firm are different depending on the broker or the country in which they work, but this can change. Usually, the country where the broker lives would tell which regulatory bodies it would fall under.

Types Of Accounts And Their Features

Expert Option offers the following account types:

The mini-account

This account offers a 50% bonus, a maximum offer of $50, a maximum of ten offers at a time and access to educational material.

The Silver account

This account benefits from an 80% bonus, a maximum offer of $100, access to educational materials, a personal account manager and a maximum of 15 open offers at a time.

The Gold account

This account has a 100% bonus, up to $300, access to educational materials, personal account management, consultation from leading trading experts, a priority for quick withdrawals, increased profit on assets, unlimited simultaneous offers.

The VIP account

This account has a 125% bonus, a maximum transaction amount of $1000, access to educational materials, a personal account manager, priority withdrawals, expert consultation in leading trading, increased profit on assets, individual analysis of your trading history and unlimited simultaneous trades.

All accounts are flexible and offer many benefits, and each account can be customized to meet the merchant’s individual needs.

Deposits And Withdrawals

- Credit/debit card (MasterCard, Visa and Union Pay)

Neteller - Skrill

- Perfect Money

- Fasapay

- Payment

Most payment methods are processed instantly, although some bank transfers can take several hours. All deposits are commission free.

The minimum deposit is just $10 (around S$13.71).

Costs And Fees, Commissions And Spreads

Each broker charges their own fees, which involve commissions, spreads, and margins. Traders should know exactly what their broker’s fees will entail before making the decision to trade with them.

The following describes exactly what a spread, margin and commissions are: The spread of a currency pair is the variance between the bid rate and the ask rate. A pip represents the smallest increment that an exchange rate can move. A pip is worth 0.01 for currency pairs with JPY as currency and 0.0001 for all other pairs.

Leverage

People who trade can use “leverage,” which means that they can get more exposure to the market with less of their own money. Leveraged products can make a trader more money, but they can also make them more likely to lose money.

For example, if you want to get 50:1, you’d need to get 100:1 or 500:1.

A trader who has $1,000 in their account and is trading 500,000 USD/JPY bills, for example, will have a lot of leverage. This leverage is called 500:1.

People who use Expert Option may be able to get different leverage rates based on the trades they think about.

If you want to trade a lot of currencies, like the EURUSD, you should set the leverage at 1:30. This level is set by official law and is the same for all regulated brokers.

Leverage is set at 1:20 for small currency pairs like the EURNOK and the NZDUSD, the AUDCAD, the USDSGD, and the EURPLN. Expert Options lets you use 500:1 to make other trades.

Bonuses

To attract new business to traders, Forex brokers normally entice them with eye-catching deposit bonuses. For new investors, this can be very convenient, but one should know what to determine as a decent bonus.

A bonus is a way to reward traders for deciding to choose a certain broker, because once the account is opened, the trader will have the same expenses as anyone else. The bonus is just a trader choice reward that gives them back some of that spend, once they have proven themselves to be an active trader.

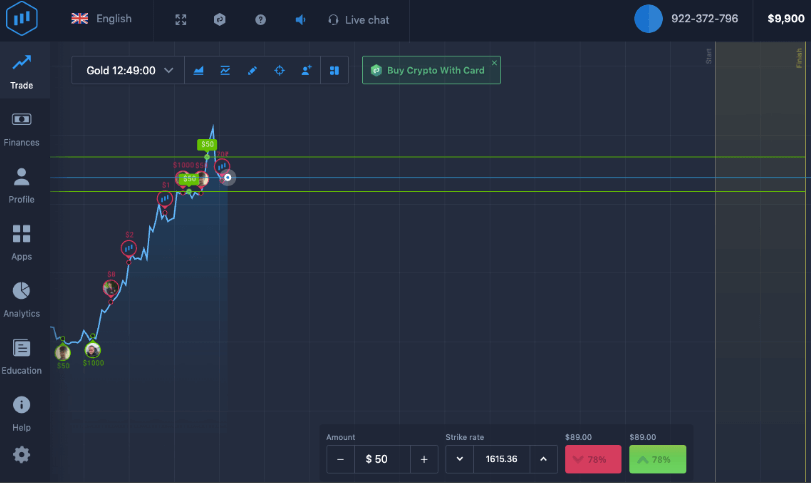

Trading Platforms, Software And Its Features

Brokers provide different trading software to their clients. This is normally called a trading platform and it is used to conduct trades.

A platform can be multi-active, which means that it allows clients to trade not only forex but also other asset classes like CFDs on stocks, stock indices, precious metals and cryptocurrencies.

Which platform to choose depends mainly on what a client wants to trade, so this will also be one of the standards when choosing a broker.

Expert Option has created its own platform instead which is fully customizable and can be tailored to each client’s needs. It is integrated with a Metatrader platform.

This means that all features offered by Expert Option are easily integrated whether the user is trading via desktop or mobile device, although the downside is that there are no external support resources available.

However, with such an intuitive interface, users are unlikely to need external resources to understand how to trade with Expert Option.

Customer Service

Prospective traders need to be sure that the person they choose to invest with will be there for them when and where they need it.

The customer service team at Expert Option can be reached by phone or email, and they also have a live chat option. When you need help from them, their customer service is available at all times.

Customers can get in touch with customer service by email, phone, or through a customer service form that is part of the dedicated Expert Option mobile app.

Education and formation

New Expert Option clients from Singapore should try to get as much information as possible about the type of trading expertise that will be needed to be successful in the world of currency and commodity trading.

The Expert Option website should provide all the information one needs to acquire skills and knowledge to trade successfully with them.

Conclusion

As an established broker with its own unique trading platform, Expert Option offers several significant advantages over many of its competitors. It is clear that Expert Option is a responsible broker with a clear focus on maintaining its user base and striving to make its clients successful. With that being said Singapore traders can feel safe when registering with Expert Option.

Expert Option FAQs

Does Expert Option Allow Singapore traders?

Yes. The broker allows Singaporean clients.

Can I trade options with Leverage?

Yes, Expert Option offers a maximum leverage of up to 500:1.

Is the Expert option regulated?

Yes, it is currently regulated by FMRRC.

Does Expert Option offer a demo account?

Yes, in fact, it is recommended that you start trading using a demo account.

No reviews yet