If you are a trader, you must be familiar with how crucial it is to choose a trustworthy platform. While the forex market is volatile, selecting a professional broker can help you predict it. It is because professional brokers have advanced tools. For example, indicators and more.

However, as the market is growing and several investors are lured into trading, numerous online trading platforms are providing financial services. With so many online trading platforms in the market, it is difficult to choose the best one. For example, that may comply with your trading strategies and options.

Other Brokers Like TD Ameritrade in Singapore

What is TD Ameritrade?

TD Ameritrade is an online trading platform that allows Singaporean traders the options of flexible trading. And provide numerous trading financial assets. For example, ETFs, stocks, futures, and more.

The minimum deposit fee is also low, and the overall platform is easy to use. In addition, the platform supports multiple and fast withdrawal options. Furthermore, the platform also offers the trade of US stocks that allow Singaporean traders to access a wide market range. So, they can earn a hefty profit.

How does TD Ameritrade work?

As specified earlier, TD Ameritrade is an online trading platform or broker that helps you trade amongst multiple options. However, to do trading on the platform, you need to create your account on the platform.

The way it works is that after creating an account on the platform, which you can create for free. It is because TD Ameritrade Singapore does not ask for any account opening fee.

Once your account has been activated by TD Ameritrade, you can search for numerous financial assets in the market. These may include derivatives, options, and more.

Note that to buy and sell stocks or for trading, you need to deposit money in your TD Ameritrade account. With that said, if you have a particular trading strategy, you also need to have some minimum deposit. For example, for day trading, you have to deposit a minimum of $2500 in your account.

With TD Ameritrade, you do not have to pay anything when you buy or sell stocks. Or, ETFs in the US market. However, $0.70 is charged by the broker on a single trade on options, and $2.41 per trade on futures.

Let’s get more details about TD Ameritrade trading platform in Singapore.

Features of Ameritrade

Some of the most popular features of TD Ameritrade are specified below.

1. No trading fees on bonds

One of the primary features of TD Ameritrade is that it does not charge a single dime on bonds. It means that you can buy different bonds from different markets such as the USA, and maximize your profit.

2. Diversified market

Another feature of TD Ameritrade is that allows Singaporean traders to trade amongst CFDs, and commodities. Moreover, the platform also allows mutual funds trading.

With so many options to trade, traders can build a diversified portfolio, and be reputable traders in the market.

3. No dividend fees

When it comes to dividend handling fees, no one comes to the TD Ameritrade platform. Several online trading platforms charge a dividend handling fee, which irritates many traders, and minimizes their profit.

However, TD Ameritrade Singapore does not charge a single penny on dividend handling. All this means that with TD Ameritrade, you can save more money, and trade worry-free. It is an important point to know when it comes to TD Ameritrade.

4. Advanced trading tools

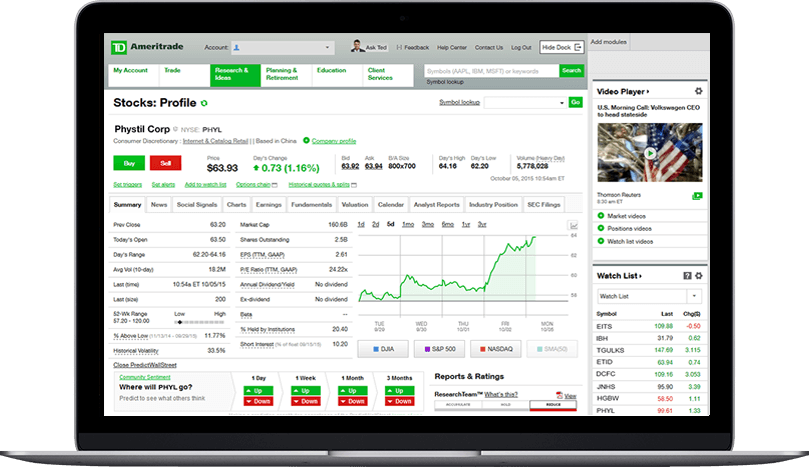

One of the best features of the platform is the advanced tools, and platforms such as the thinkorswim. With the thinkorswim platform, traders can access numerous tools, such as charts, indicators, and other charting tools. All these tools can help traders analyze the current situation of the market. And decide whether they should go long or short with their assets.

5. Research tools

TD Ameritrade also has some of the best research tools that help both advanced and novice traders. Moreover, research tools provided by the platform also allow traders to gather qualitative and quantitative data.

This type of data can help traders to improvise their trading strategy, which could help them earn more profit.

6. Educational resources

Another great feature of the platform is that it has various and easy-to-access educational resources. All these resources are easy to comprehend and are viable to all kinds of traders.

With the platform’s educational resources, traders can learn how to properly use the platform. Moreover, they can learn how to use technical indicators, and choose a suitable trading strategy as well.

Benefits of TD Ameritrade in Singapore

There are several benefits of using TD Ameritrade in Singapore. Some of the best benefits are as follows:

- Safety – The platform is perfectly safe as it is authorized by several financial governing bodies. This includes the Monetary Authority of Singapore (MAS). Being authorized by the higher authorities helps traders with risk-free trading. However, it is worth mentioning that some scammers are always there in the market. So, it is your responsibility to run a background check on the trader you are considering trading with.

- Great user experience – The platform has an overall great user experience. The layout is easy to use, and the navigation system is flawless. Moreover, TD Ameritrade is also responsive, which means you can do mobile trading as well.

- Filter options – One of the popular benefits of the platform is that it has an integrated filter option. Typical online trading platforms rarely have any filter option. It means that it takes time for traders to search for their desired asset and do trading.

However, with the platform’s filter options, you can select what asset you want. For example, ETFs, bonds, mutual funds, options, etc.

- Excellent customer support – The platform supports multiple help channels, such as WhatsApp, email, and phone. Moreover, the overall customer support is fast and responsive.

Cons

- You cannot create a demo account on the platform.

- The platform does not support local language assistance.

- Account opening takes too much time, which is 20-30 days.

- The update takes time.

Conclusion

It is a brief review of TD Ameritrade Singapore. Overall, the platform is good and has some added functionalities and features. Although the account opening process takes a bit of your time, in the end, the platform is worth it.

No reviews yet